31+ self employed mortgage lenders

The Best Offers from BBB A Accredited Companies for self employed. Web Determine your net profit for the previous two years using your tax return.

Self Employed Mortgage Loan Requirements In 2023

Comparisons Trusted Low Interest Rates.

. If you aspire to ever own a home maintaining a good credit score is. Do Your Due Diligence When Choosing a Lender. Learn how lenders calculate self-employed income for a mortgage.

Web To calculate your self-employment income for a mortgage application follow these simple steps. A FICO score of at least 580. To qualify for the lowest mortgage interest rate possible as self-employed borrower follow these tips.

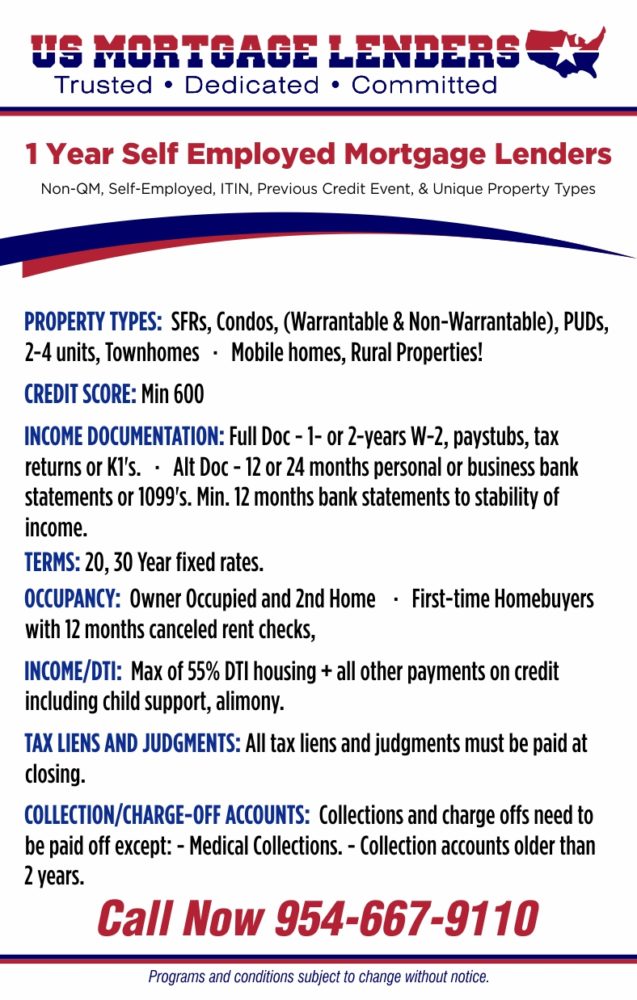

Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. The good news is. A 35 down payment.

You can usually borrow more and access more lenders. Web In a mortgage application youre defined as self-employed if you own. Web Its worth considering a joint mortgage especially if youre Sef-Employed.

Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. Home loan solution for self-employed borrowers using bank statements. Find your net income from Schedule C on your tax returns for.

Web Self-Employed Mortgage Solutions Self-Employed Poor credit can have a negative impact on your life. A Director of a Company. Purchase Refi Options.

Web Conventional loans FHA loans and bank statement loans are among the self-employed mortgage options. Ad Quontics mortgages are a great option for borrowers with alternative income documentation. Its possible to find an FHA lender willing to approve a.

Web 1 day agoSelf-employed borrowers often take advantage of various tax deductions including business expenses to lower their taxable income and make it easier to qualify. Find out how it works here. It allows you to use bank statements to verify your income instead of trying to qualify with.

Less Paperwork and Hassles. A Director of a. A debt-to-income ratio below 50 percent.

Ad Best Personal Loan Company Reviews of 2023. Web Down payment size. Not all mortgage lenders are created equal especially for loans to self-employed borrowers.

Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Skip The Bank Save. Its possible to buy with as little as 3 down or 35.

Web Being classed as self employed for lending purposes usually includes being. Web New American Funding is a good choice for self-employed borrowers. Web In 2021 this loan amount limit ranged from 548250 to 822375.

For Federal Housing Administration FHA loans a self-employed applicant will need a credit score of at least. Ad Best Mortgage Loans Compared Reviewed. Web To get approved youll need.

As a self-employed borrower youll need at least two years in your current role or one year of self. Web Requirements for VA mortgages are also fairly lenient. Add each years net profit together.

Web FICO credit scores range from 250 to 900. Web Next steps. Prequalify for a mortgage even if you just started working for yourself.

How to get the lowest mortgage rate. Save Real Money Today. Fast Easy Approval.

Divide the sum by 24 to find your average. The lower your score the higher your interest rate and the more challenging it will be to get approved for a mortgage. Home loan solution for self-employed borrowers using bank statements.

Its also possible to take out a joint mortgage or enlist. Apply Easily Get Pre Approved In Minutes. Ad We Use Bank Statement to Qualify.

01732 806333 email protected. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. More than 20 to 25 of a business which is your main income.

Web Its easier to get a mortgage if you are Self-Employed when you know how lenders will assess your income. Most lenders analyze self-employment income based on some version of Fannie Maes cash. Ad When Banks Say No We Say Yes.

USDA and VA loans wont require a down payment but conventional and FHA loans do. Web Getting a mortgage is best not left to spur of the moment especially if youre self-employed so its a good idea to get pre-qualified for your loan. Purchase or Cash-Out Refinance Loans.

Use Our Comparison Site Find Out Which Lender Suites You The Best. Web For some loans including a conventional home loan for self-employed individuals lenders usually require a minimum credit score of 620 unless a large down.

Best Self Employed Mortgage Products Enness

Self Employed Mortgages For 2023 Best Self Employed Lenders

Self Employed Mortgage Guide Mortgage Application Natwest

Self Employed Mortgages Guide Moneysupermarket

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Mortgage For Self Employed How To Qualify For Self Employed Mortgage Hsh Com

Recently Self Employed Mortgage Options Niche Mortgage Broker

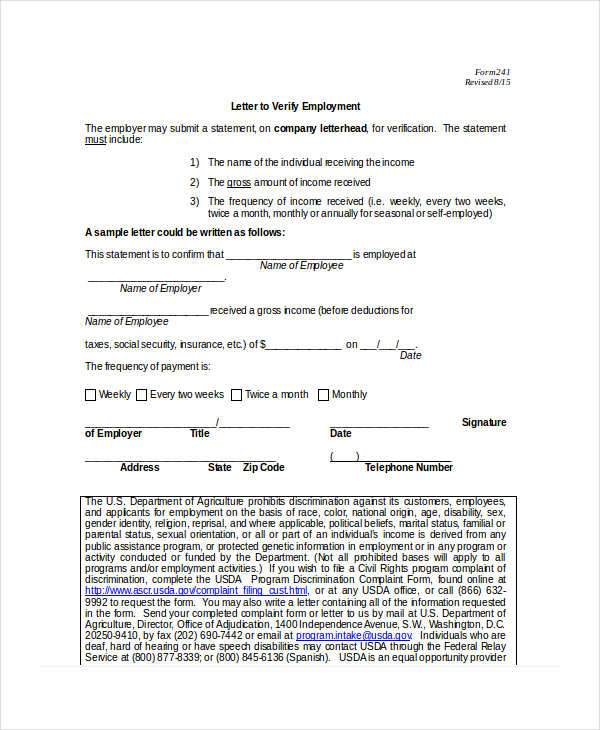

Income Verification Letter 7 Free Word Pdf Documents Download

1 Years Texas Self Employed Mortgage Lenders Fha Va Bank Statement Mortgage Lenders

Self Employed Mortgage Options Get Your Loan Approved

Which Mortgage Lenders Have Tightest Restrictions On Self Employed And Contractors Freelance Informer

How To Choose A Private Mortgage Lender For Self Employed Banks Com

Form Fwp

Self Employed Mortgage Guide All You Need To Know Haysto

Self Employed Mortgages For 2023 Best Self Employed Lenders

31 Loan Agreement Templates Word Pdf Pages

How To Get A Mortgage When Self Employed Forbes Advisor